LAPORAN KEBERLANJUTAN TAHUN 2024

PT SINARMAS HANA FINANCE

MEMBANGUN BUDAYA KEBERLANJUTAN

PT Sinarmas Hana Finance (Selanjutnya di sebut PT SHF) secara konsisten sebagaimana di sampaikan tahun-tahun sebelumnya menerapkan dan membangun budaya keberlanjutan melalui implementasi awal atas keuangan berkelanjutan sesuai road map, berdasarkan konsep keuangan berkelanjutan sebagaimana yang tertuang dalam POJK No. 51/POJK.03/2017 tentang Penerapan Keuangan Berkelanjutan bagi Lembaga Jasa Keuangan, Emiten, dan Perusahaan Publik. Pelaksanaan sosialisasi telah dilakukan secara bertahap baik secara daring dan non daring kepada karyawan dan semua pemangku kepentingan, baik di Kantor Pusat dan di Kantor Cabang (KC), di setiap jenjang atau level organisasi mulai dari Direksi hingga level staff, agar karyawan memiliki pemahaman /visi yang sama sehingga menjadi pondasi dalam membangun budaya keberlanjutan di PT SHF.

PT SHF selama tahun 2024 telah dan selalu berkomitmen kuat mendukung usaha-usaha keberlanjutan lingkungan hidup, khususnya dalam aktivitas kehidupan sehari-hari di lingkungan perusahaan dan produk pembiayaan. Gerakan untuk menciptakan budaya go-green di lingkungan Perusahaan telah diterapkan secara menyeluruh dalam berbagai bentuk efisiensi penggunaan kertas, penggunaan tumbler (tempat minum) masing-masing karyawan yang berbahan daur ulang, hemat penggunaan air, hemat penggunaan listrik (lampu, AC hemat energi, dll) dan produk pembiayaan, di mana pada tahun 2024 PT SHF telah memberikan pembiayaan kendaraan Listrik.

Kegiatan membangun budaya keberlanjutan terefleksi dari strategi Perusahaan dalam mengedepankan penerapan digitalisasi dalam kegiatan usaha maupun di dalam menjalankan tata Kelola Perusahaan secara keseluruhan (Komprehensif). PT SHF telah melakukan pengembangan sistem teknologi informasi secara terus dan menerus dan telah terintegrasi antara mitra usaha, konsumen, Kantor Pusat, dan Kantor Cabang (KC).

DAMPAK POSITIF PENERAPAN KEUANGAN BERKELANJUTAN BAGI MASYARAKAT DAN LINGKUNGAN

Dampak dari penerapan keuangan keberlanjutan bagi masyarakat dan lingkungan PT SHF salah satu gambaran dampak positifnya adalah dengan berkurangnya penggunaan kertas seiring shifting online aktifitas kantor di mana sebelumnya harus menggunakan kertas menjadi tidak perlu kertas mengakibatkan penurunan jumlah permintaan kertas, mengurangi jumlah pohon yang harus di tebang, listrik dan atau batu bara untuk produksi kertas akan menghasilkan kualitasi udara yang bagus, dan sebagainya. Selain itu dengan pembiayaan Motor Listrik (molis) bekerjasama dengan Gojek dan Grab telah turut andil dalam memberikan lapangan pekerjaan yang berkelanjutan dengan pengurangan emisi gas buang dan ramah lingkungan.

PEDOMAN STANDAR PENYUSUNAN LAPORAN KEBERLANJUTAN TAHUN 2024

Laporan Keberlanjutan PT SHF Tahun 2024 disusun dengan mengakomodasi Peraturan Otoritas Jasa Keuangan No. 51/POJK.03/2017 tentang Penerapan Keuangan Berkelanjutan bagi Lembaga Jasa Keuangan, Emiten, dan Perusahaan Publik beserta lampirannya. Laporan Keberlanjutan ini tidak lepas dari laporan keuangan audited untuk tahun buku 2024. Informasi yang disajikan dalam Laporan keberlanjutan PT SHF Tahun 2024 ini meliputi data dan informasi yang dalam rentang waktu 1 (satu) tahun yaitu mulai tanggal 1 Januari sampai dengan 31 Desember 2024. Prinsip penetapan isi daripada Laporan ini didasarkan pada POJK 51/POJK.03/2017 dan disusun berdasarkan 2 prinsip, yaitu prinsip isi dan kualitas.

Prinsip isi meliputi:- Konteks berkelanjutan: Laporan Keberlanjutan (Sustainability Report) ini disusun sejalan dengan konteks keuangan berkelanjutan yang dinamis dan terkini.

- Kelengkapan: Informasi disajikan sebagai informasi kualitatif dan kuantitatif untuk memberikan kelengkapan bagi pembaca di dalam membaca dan mengerti laporan ini.

- Keseimbangan: Informasi terkait capaian dan prestasi, serta tantangan disampaikan sesuai dengan kondisi perusahaan.

- Komparabilitas: Data yang disampaikan dalam laporan disajikan dalam 3 (tiga) tahun terakhir.

- Akurasi: Angka dan informasi telah diperiksa secara internal dan eksternal PT SHF sehingga diyakini validitas dan akurasinya.

- Kejelasan: Keterbukaan informasi apa adanya.

Selain dari POJK No. 51 Tahun 2017, sebagai dasar dalam pembuatan laporan ini adalah Undang-Undang No. 32 Tahun 2009 tentang Perlindungan dan Pengelolaan Lingkungan Hidup untuk mengembangkan dan menerapkan instrumen ekonomi lingkungan hidup, termasuk di dalamnya adalah kebijakan yang ramah lingkungan hidup di bidang perbankan, pasar modal, dan industri keuangan nonbank.

STRATEGI KEBERLANJUTAN

Tahun 2024 merupakan tahun ke-5 dari penerapan Keuangan Berkelanjutan berdasarkan Pasal 3 Peraturan OJK Nomor 51/POJK.03/2017 tentang Penerapan Keuangan Berkelanjutan Bagi Lembaga Jasa Keuangan, Emiten, dan Perusahaan Publik. Oleh karena itu, Perusahaan telah melaksanakan implementasi Rencana Aksi Keuangan Berkelanjutan (RAKB) tahun 2024 dengan tujuan untuk menjadi Perusahaan yang terpercaya dan unggul dalam mencapai tujuan pembangunan berkelanjutan di Indonesia, yang dilaksanakan melalui strategi utama yaitu: pemahaman dan implementasi/pelaksanaan atas wawasan dan pengetahuan keuangan keberlanjutan yang telah di pahami dan di mengerti oleh setiap pimpinan kepada seluruh staffnya masing-masing melalui kegiatan nyata.

Pada tahun ke lima implementasi RAKB, berdasarkan evaluasi PT SHF, strategi berkelanjutan Perusahaan telah berhasil melaksanakan kegiatan yang telah di rumuskan dengan baik khususnya di bidang penghematan kertas, penghematan listrik, penghematan botol sekali pakai, pembiayaan kendaraan Listrik dan dan hal-hal yang terkait di imbangi dengan program pengembangan dan pelatihan Keuangan Berkelanjutan guna untuk mempersiapkan sumber daya manusia di internal Perusahaan dalam mengimplementasikan Keuangan Berkelanjutan.

Diyakini bahwasannya melalui pemahaman dan kesadaran yang baik akan mendorong tumbuhnya kepedulian atas penerapan Keuangan Berkelanjutan dilingkungan bisnis Perusahaan yang diharapkan akan tercipta inisiatif dan inovasi terhadap produk dan jasa Keuangan Berkelanjutan yang dikembangkan sesuai dengan prinsip-prinsip Keuangan Berkelanjutan yang bukan sekedar retorika belaka.

Adapun faktor-faktor yang di pertimbangkan baik internal maupun eksternal, seperti kondisi keuangan Perusahaan, kapasitas teknis, dan kapasitas organisasi serta sumber daya manusia yang dimiliki Perusahaan.

Perusahaan telah menyusun Strategi Keberlanjutan untuk jangka waktu 5 (lima) tahun, yaitu untuk periode tahun 2020 sampai dengan tahun 2024, dengan pembagian kedalam 3 (tiga) tahap yang terdiri dari implementasi awal (periode tahun 2020 – 2022), implementasi lanjutan (periode tahun 2022 – 2023), dan implementasi penuh (tahun 2024) telah berjalan dengan baik dengan beberapa catatan.

Untuk mewujudkan pertumbuhan yang berkelanjutan, Perusahaan berupaya membangun landasan yang kuat dengan meningkatkan kualitas sumber daya manusia melalui kegiatan pelatihan dan awarnes melalui social media dan media lain yang ada di perusahaann, diharapkan dapat menghasilkan sumber daya manusia yang profesional dan berintegritas tinggi dan dapat mendukung penerapan Keuangan Berkelanjutan di Perusahaan.

Laporan Keberlanjutan sebagai salah satu daripada laporan kepada masyarakat akan akuntabilitas dan transparansi PT SHF atas akibat dari kegiatan operasinya terhadap ekonomi, lingkungan hidup dan sosial. Laporan ini merupakan salah satuan kontribusi PT SHF terhadap pencapaian Tujuan Pembangunan Berkelanjutan di Indonesia.

Pelaksanaan daripada strategi Keberlanjutan PT SHF merupakan bagian dari pelaksanaan Tanggung Jawab Sosial dan Lingkungan serta penerapaan ESG, dan satu kesatuan dari Tata Kelola Perusahaan yang Baik atau Good Corporate Governance (GCG).

Adapun tujuan dari keuangan keberlanjutan adalah sbb:

- Menciptakan produk dan/atau jasa keuangan yang menerapkan prinsip Keuangan Berkelanjutan (ESG);

- Kegiatan perusahaan pembiayaan agar selaras dengan prinsip-prinsip ekonomi, sosial, dan lingkungan (ESG) di mana hal ini sesuai dengan arah dan kebijakan dari Perusahaan induk di korea;

- Integrasi aspek keberlanjutan dalam operasional dan pengambilan keputusan, PT SHF dapat mengelola risiko dengan lebih baik, meningkatkan efisiensi, dan menciptakan peluang baru. (blue ocean);

- Bisa menghindari potensi risiko lingkungan dan sosial yang terkait dengan proyek atau bisnis yang sedang dan akan di jalankan oleh PT SHF;

- Mendorong PT SHF untuk menciptakan produk-produk pembiayaan baru yang berkesinambungan dan memberikan profitabilitas kepada semua pemangku kepentingan sebagaimana di sebutkan dalam point tiga (3) di atas;

- Tranparansi dan akuntabilitas PT SHF;

- Mendapatkan insentif sebagaimana di atur di dalam POJK NO 51/2017.

Adapun beberapa strategi yang dilakukan adalah sbb:

- Pengembangan Produk dan Layanan Keuangan Berkelanjutan seperti pembiayaan motor dan mobil Listrik;

- Kerjasama dengan pihak ketiga di dalam mengembankan keuangan keberlanjutan contoh: electrum;

- Bekerjasama dengan pihak ketiga di dalam memitigasi risiko khususnya Perusahaan asuransi yang bisa mengcover produk-produk pembiayaan yang berorientasi keberlanjutan;

- Menerapkan praktik-praktik untuk mengurangi dampak lingkungan dari operasional perusahaan sendiri, seperti efisiensi energi (Listrik) penggunaan kertas, penggunaan ememo untuk berbagai approval;

- Transparansi kegiatan usaha melalu berbagai media yang ada;

- Meningkatkan kesadaran dan pemahaman tentang keuangan berkelanjutan di kalangan internal perusahaan dan para pemangku kepentingan (literasi);

- Penggunaan teknologi informasi di dalam operational PT SHF.

IKHTISAR KINERJA ASPEK KEBERLANJUTAN

| a. Aspek Ekonomi (dalam rupiah) | |||

|---|---|---|---|

| Keterangan | Tahun 2024 | Tahun 2023 | Tahun 2022 |

| Pembiayaan Multiguna | 367 Miliar | 437 Miliar | 384 Miliar |

| Pembiayaan Modal Kerja | 643 Miliar | 658 Miliar | 747 Miliar |

| Pembiayaan Investasi | 407 Miliar | 296 Miliar | 238 Miliar |

| Kewajiban | 1.272 Miliar | 1.171 Miliar | 1.057 Miliar |

| Laba Sebelum Pajak | -77 Miliar | 9 Miliar | 30 Miliar |

| Pendapatan | 190 Miliar | 221 Miliar | 200 Miliar |

| b. Aspek Lingkungan | |||

|---|---|---|---|

| Keterangan | Tahun 2024 | Tahun 2023 | Tahun 2022 |

| Penggunaan Listrik | 1,5 Miliar | 1,5 Miliar | 1,4 Miliar |

| Penggunaan Kertas | 15 Juta | 206 Juta | 262 Juta |

Dari total Rp 1.417 Triliun asset pembiayaan PT SHF terdapat porsi pembiayaan Motor Listrik per Desember tahun 2024 sebesar Rp 40.6 Miliar.

Sehubungan dengan kesempatan, kesetaraan dalam bekerja PT SHF memberikan kesempatan kepada semua Warga Negara Indonesia untuk terlibat di dalam kegiatan PT SHF. Adapun detailnya adalah sbb:

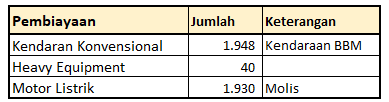

Pembiayaan dalam tahun 2024 dapat di sampaikan sbb:

Di dalam menyalurkan pembiayaan tersebut di atas disalurkan melalui saluran yang ada di PT SHF meliputi 12 cabang dan satu cabang sales point serta kantor pusat secara langsung. PT SHF secara inklusif memastikan ketersediaan dan keterjangkauan akses terhadap produk dan layanan yang diberikannya melalui keberadaan 12 kantor-kantor di pulau jawa dengan di sertai oleh kegiatan literasi keuangan.

Dengan kegiatan tersebut juga memberikan dampak sosial dengan perekrutan tenaga kerja di seputaran kantor cabang PT SHF berlokasi dan juga multiplier efek / penggerak roda ekonomi di daerah sehingga bisa menggerakan perekonomian di daerah.

Untuk menunjang keberlanjutan PT SHF di dalam memberikan pengingat untuk membayar angsuran dan atau keterlambatan angsuran sudah menggunakan media Whatsapp sebagai secara komunikasi yang otomatis mengurangi biaya pengadaaan kertas.

PROFIL SINGKAT PT SINARMAS HANA FINANCE

Visi dan Misi

Keberlanjutan merupakan bagian komitmen PT Sinarmas Hana Finance dalam mewujudkan visi Perusahaan yakni menjadi Perusahaan Pembiayaan utama andalan masyarakat yang berperan sebagai pilar penting perekonomian Indonesia.

VISI

Menjadi pemimpin Perusahaan Pembiayaan dengan Pelayanan Kelas Dunia. Visi ini menggambarkan bahwa Perusahaan akan terus memperluas bisnis untuk terus mempromosikan standar layanan terbaik bagi pelanggan.

MISI

- Sebagai perusahaan pembiayaan dengan jaringan luas terintegrasi seluruh Indonesia;

- Teknologi Informasi yang sesuai;

- Pembinaan sumber daya manusia dapat diandalkan;

- Mengelola perusahaan dengan tata kelola Perusahaan yang baik (transparansi, akuntabilitas, tanggung jawab, kemandirian, dan kesetaraan).

Nilai dan Budaya Perusahaan

- Passion: Semangat sebesar Matahari. Melaksanakan tugas sebaik baiknya dengan penuh tanggung jawab serta mengejar nilai yang lebih tinggi dengan perubahan dan pembaharuan.

- Openess: Hati yang terbuka seperti Langit. Memahami hati orang dan keadaannya serta memiliki perasaan yang sama dengan pandangan luas dan terbuka.

- With Customer: Melayani pelanggan seperti Raja. Mencari dan memenuhi keperluan para pelanggan dengan bertujuan mengutamakan kepentingan mereka.

- Excelence: Keahlian bercahaya seperti Bintang. Mengembangkan kemampuan diri yang berkualitasi bidang masing-masing untuk mendapatkan kepercayaan terbaik dari para pelanggan.

- Respect: Menjunjung tinggi dengan sepenuh hati, pikiran dan berbuat dengan menjunjung tinggi tanggapan lawan bicara berdasarkan pada sikap memanfaatkan kemampuan diri sendiri dan saling membantu.

- Integrity: Integritas seperti Gunung. Selalu melaksanakan tugas dengan jujurdan ikhlas sesuai dengan etika kerja keuangan.

INFORMASI PERUSAHAAN

| Nama Perusahaan | Alamat | Nomor Telepon | Fax | Situs Web | |

|---|---|---|---|---|---|

| PT Sinarmas Hana Finance | Mangkuluhur City Office Tower One Lt. 16 Jl. Jend. Gatot Subroto Kav.1-3, Karet Semanggi, Setiabudi, Jakarta Selatan, DKI Jakarta 12930 | 021 5695 4670 | 021 5695 4678 | shf.co.id | customercare@shf.co.id |

KANTOR CABANG

| Cabang | Alamat |

|---|---|

| Cabang Jakarta | Mangkuluhur City Office Tower One Lt. 16 Jl. Jend. Gatot Subroto Kav.1-3, Karet Semanggi, Setiabudi, Jakarta Selatan, DKI Jakarta 12930 |

| Cabang Depok | Jl. Arif Rahman Hakim No. 69, RT.3/RW.13, Beji, Kecamatan Beji, Kota Depok, Jawa Barat 16421 |

| Cabang Bekasi | Ruko Mutiara Bekasi Center Kav. 10 Blok C No. 10, Jl. Jend. Ahmad Yani, RT.005/RW.002, Marga Jaya, Kec. Bekasi Selatan, Kota Bekasi, Jawa Barat 17141 |

| Cabang Tangerang | Ruko Bolsena Blok C No 28, Jl. Boulevard Raya Gading Serpong, Kelurahan Curug Sangereng, Kec. Klp. Dua, Tangerang, Banten 15810 |

| Cabang Bogor | Jl Raya Pajajaran Komp. Ruko Bantarjati No. 96 N, RT.02/RW.03, Kel. Bantarjati, Kec. Bogor Utara, Kota Bogor, Jawa Barat 16153 |

| POS (Point of Sales) Karawang | Jl. Kertabumi No. 10A, Kel. Karawang Kulon, Kec. Karawang Barat, Kab Karawang, Jawa Baratt |

| Cabang Solo | Jl. Slamet Riyadi No. 259, Ruko Lojigandrung Blok B5, Kel. Penumping, Kec. Laweyan, Kota Surakarta, Jawa Tengah 57141 |

| Cabang Bandung | Jl. Mekar Utama No. 111P Komp. Mekarwangi, Kec. Bojongloa Kidul, Kota Bandung, Jawa Barat 40237 |

| Cabang Semarang | Jl. Mayor Jend. D.I. Panjaitan No.90C, Kel. Jagalan, Kec. Semarang Tengah, Kota Semarang, Jawa Tengah 50241 |

| Cabang Kediri | Jl. Pemuda No. 11B, Dandangan, Ngadirejo, Kec. Kota, Kota Kediri, Jawa Timur 64112 |

| Cabang Yogyakarta | Ruko Casa Grande No 12, Jl. Ring Road Utara, Maguwoharjo, Kec. Depok, Kabupaten Sleman, Daerah Istimewa Yogyakarta 55282 |

| Cabang Malang | Ruko De Panorama Square, Jl. A. Yani Malang A-3B, Kec. Blimbing, Kota Malang, Jawa Timur 65125 |

| Cabang Surabaya | Jl. Raya Manyar No. 36, Kel. Baratajaya, Kec. Gubeng, Kota Surabaya, Jawa Timur 60284 |

PERSENTASE PEMEGANG SAHAM

| No | Pemilik Saham | Persentase |

|---|---|---|

| 1 | Hana Capital Co. Ltd | 55% |

| 2 | PT. Bank KEB Hana Indonesia | 30% |

| 3 | PT. Sinarmas Multiartha Tbk | 15% |

WILAYAH OPERASIONAL

| DKI Jakarta | Jawa Barat | Jawa Tengah | Jawa Timur |

|---|---|---|---|

| Jakarta Barat | Tangerang | Yogyakarta | Surabaya |

| Bandung | Semarang | Malang | |

| Bogor | Solo | Kediri | |

| Depok | |||

| Karawang | |||

| Bekasi |

Hingga akhir tahun 2024 Perusahaan memiliki 12 Kantor Cabang dan 1 Kantor Selain Kantor Cabang/Point of Sales yang tersebar di seluruh pulau jawa.

INFORMASI PRODUK, LAYANAN DAN KEGIATAN USAHA

Kegiatan usaha Perusahaan pada saat ini pada kegiatan pembiayaan multiguna untuk pembelian mobil bekas dan pembiayaan modal kerja serta investasi. Pembiayaan investasi dan modal kerja mayoritas di khususkan untuk debitur koporasi sedangkan pembiayaan multiguna dengan segment untuk retail yang bersifat konsumtif khususnya untuk pembelian mobil bekas secara angsuran dan kebutuhan akan dana.

Kegiatan usaha sebagaian besar berlokasi di Pulau Jawa terkecuali untuk pembiayaan korporasi berlokasi di Pulau Sumatra, Kalimantan, Sulawesi dan Maluku. Untuk pembiayaan korporasi PT SHF berkolaborasi dengan Perusahaan Pembiayaan lainnya terutama yang terafiliasi dengan kepemilikan dari Korea Selatan.

Sebagai penerapan prinsip kehati-hatian, maka plafon persetujuan kredit untuk setiap jenjang dibuat tidak terlalu besar untuk setiap aplikasi kredit. Wewenang memutuskan kredit tersebut selalu ditinjau secara berkala dan ditetapkan berdasarkan rekomendasi dari suatu Komite Kredit yang perlu mendapat persetujuan dari Komisaris Perseroan. Hal ini sejalan dengan prinsip kehati-hatian (prudent financing) yang dianut Perusahaan.

Perseroan memiliki kebijakan kredit yang diharapkan mampu menekan tingkat piutang yang bermasalah seminimal mungkin dalam menjalankan kegiatan usahanya. Untuk mengelola kegiatan usaha pembiayaan serta upayanya untuk selalu menjaga tingkat kolektibilitas yang baik maka kegiatan penagihan merupakan salah satu kunci keberhasilan Perusahaan.

KEANGGOTAAN ASOSIASI

ASOSIASI PERUSAHAAN PEMBIAYAAN INDONESIA (APPI)

Manfaat Keanggotaan : Sebagai tempat informasi bagi Perusahaan untuk berdiskusi dan memecahkan permasalahan, memberikan masukan-masukan, mengadakan pertemuan dan mengolah data atau bahan-bahan keterangan yang berhubungan Peraturan Perundang-undangan juga Peraturan Otoritas Jasa Keuangan dengan masalah-masalah mengenai lembaga pembiayaan dalam arti yang seluas-luasnya.

Karyawan PT SHF juga aktif di APPI dengan menjadi pengurus APPI di daerah/cabang PT SHF berlokasi seperti di Solo, Semarang dan Kediri.

Kegiatan Seminar Nasional APPI:

- Seminar Nasional Asosiasi Perusahaan Pembiayaan Indonesia “Seminar Nasional – Tantangan Pembiayaan Tahun 2024” tanggal 30 Januari 2024, yang dihadiri oleh Bapak Herry Hermana (Komisaris Independen) dan Bapak Andrew Ludy (Direktur Bisnis).

- Seminar Internasional Asosiasi Perusahaan Pembiayaan Indonesia “International Strengthening Multifinance Industry in Indonesia” tanggal 21 Mei 2024, yang dihadiri oleh Bapak Seo Jisu (Direktur Utama) dan Bapak Park Dong Wook (Komisaris Utama).

- Seminar Nasional Asosiasi Perusahaan Pembiayaan Indonesia “Seminar Nasional – Tantangan Pembiayaan di Tengah Tahun Geopolitik dan Ekonomi” tanggal 04 Juni 2024, yang dihadiri oleh Bapak Andrew Ludy (Direktur Bisnis) dan Bapak Agustinus Budi Antoro (Direktur Kepatuhan).

- Seminar Internasional Asosiasi Perusahaan Pembiayaan Indonesia “International Seminar – The Fed's Interest and Enhancing Market Share” tanggal 06 Agustus 2024, yang dihadiri oleh Bapak Seo Jisu (Direktur Utama) dan Bapak Nasser Atorf (Komisaris).

- Seminar Nasional Asosiasi Perusahaan Pembiayaan Indonesia “Seminar Nasional – Economic Outlook 2025” tanggal 01 Oktober 2024, yang dihadiri oleh Bapak Agustinus Budi Antoro (Direktur Kepatuhan).

RAPINDO

PT SHF juga menjadi anggota Rapindo sebagai salah satu bentuk Tata Kelola Perusahaan Yang Baik. Dengan menjadi anggota Rapindo PT SHF bisa mendapatkan manfaat terhindar dari tindakan kriminal dari pembiayaan ganda dengan jaminan BPKB dan atau tagihan piutang. Selain itu PT SHF juga bisa berkontribusi terhadap industri Perusahaan Pembiayaan dengan memberikan datanya ke Rapindo sehingga bisa menolong Perusahaan Pembiayaan lainnya terhindar dari kegiatan double pembiayaan.

PERUBAHAN DI TAHUN 2024 YANG SIGNIFIKAN

Di tahun 2024 tidak ada perubahan signifikan PT SHF fokus kepada pembiayaan kendaraan listrik dan melakukan tindakan mitigasi risiko terhadap potensi kerugian yang timbul akibat naiknya overdue debitur korporasi.

TATA KELOLA KEBERLANJUTAN

Perusahaan meyakini pentingnya penerapan tata kelola perusahaan yang konsisten pada setiap tingkatan organisasi dan setiap aktivitas perusahaan. Struktur tata kelola Perusahaan yang menggambarkan pengelolaan Tata Kelola Perusahaan yang Baik atau Good Corporate Governance (GCG) di lingkup Perusahaan mencakup 3 (tiga) organ utama Perusahaan, yaitu:

Rapat Umum Pemegang Saham (RUPS)

Sebagai forum bagi Para Pemegang Saham dalam mengambil keputusan strategis bagi kelangsungan Perusahaan, RUPS wajib dilaksanakan minimal satu tahun sekali sedangkan RUPS LB berdasarkan situasi dan atau permintaan dari pemangku kepentingan sebagaimana di atur di dalam anggaran dasar Perusahaan. Selain melalui pertemuan RUPS juga dilakukan melalui sirkuler.

Dewan Komisaris

Dewan Komisaris bertugas sbb:

- Memastikan bahwa Perusahaan memiliki strategi bisnis yang efektif, termasuk di dalamnya memantau jadwal, anggaran dan efektifitas strategi tersebut.

- Memberikan nasehat, tanggapan dan atau persetujuan kepada Perusahaan dalam hal ini Direktur dalam setiap mengambil kebijakan dan keputusan yang dapat mempengaruhi kinerja Perusahaan.

- Mengarahkan, memantau, dan mengevaluasi pelaksanaan kebijakan strategis Perusahaan.

- Komisaris tidak terlibat dalam pengambilan keputusan kegiatan operasional Perusahaan, kecuali dalam hal penyediaan dana kepada pihak terkait dan hal-hal lain yang ditetapkan dalam anggaran dasar Perusahaan dan/atau ketentuan peraturan perundangan-undangan dalam rangka melaksanakan fungsi pengawasan.

- Memastikan bahwa Direksi telah menindaklanjuti temuan audit dan rekomendasi dari satuan kerja yang membidangi audit internal Perusahaan, auditor eksternal, hasil pengawasan Otoritas Jasa Keuangan dan/atau hasil pengawasan otoritas lainnya.

- Terlibat aktif di dalam Komite Audit Perusahaan, Komite Pemantau Risiko, Komite Nominasi dan Remunerasi.

- Wajib mengadakan dan melaksanakan Rapat Komisaris minimal sekali dalam satu kuartal dan rapat bersama dengan Dewan Direksi satu kali dalam setiap kuartal.

- Memastikan PT Sinarmas Hana Finance telah menjalankan perlindungan konsumen dengan baik dan berkeadilan bagi semua pemangku kepentingan.

Direksi

Berfungsi untuk melakukan pengelolaan operasi dan bisnis Perusahaan. Struktur ini telah sesuai dengan Undang-Undang Nomor 40 Tahun 2007 tentang Perseroan Terbatas dan Peraturan Otoritas Jasa Keuangan No. 30/POJK.05/2014 tentang Tata Kelola Perusahaan Yang Baik Bagi Perusahaan Pembiayaan junto Peraturan Otoritas Jasa Keuangan No. 29/POJK.05/2020 tentang Perubahan atas Peraturan Otoritas Jasa Keuangan No. 30/POJK.05/2014 tentang Tata Kelola Perusahaan Yang Baik Bagi Perusahaan Pembiayaan.

Di dalam membangun budaya Keuangan Berkelanjutan, Perusahaan telah menyusun Rencana Aksi Keuangan Berkelanjutan 2023 dan 2024, yang keseluruhan penerapan tata kelola keberlanjutan menjadi tanggung jawab semua pemangku kepentingan Perusahaan, termasuk Dewan Komisaris serta jajaran Direksi yang ikut terlibat dalam pengawasannya.

Tugas Direksi:

- Direksi bertanggung jawab penuh dalam melaksanakan tugasnya untuk kepentingan Perseroan dalam mencapai maksud dan tujuannya.

- Setiap anggota Direksi wajib dengan itikad baik dan tanggung jawab menjalankan tugasnya dengan mengindahkan Peraturan Perundang-Undangan yang berlaku.

- Direksi berhak mewakili Perseroan di dalam dan di luar Pengadilan tentang segala hak dan dalam segala kejadian, mengikat Perseroan dengan pihak lain dan pihak lain dengan Perseroan, serta menjalankan segala tindakan, baik yang mengenai kepengurusan maupun kepemilikan, akan tetapi dengan pembatasan bahwa untuk:

- Meminjam uang atau menerbitkan surat tanda pinjaman uang, obligasi atau surat utang;

- Pembentukan setiap anak perusahaan atau penanaman modal/penyertaan modal atau menjual/mengalihkan/melepaskan kepentingan Perseroan dalam perusahaan lain;

- Pengesahan atas rencana kerja dan anggaran tahunan Perseroan lain;

- Mengadakan perjanjian dengan terafiliasi Perseroan (selain dari pada kontrak-kontrak teknikal asisten yang telah disepakati para pemegang saham;

- Setiap pengeluaran yang jumlahnya tidak termasuk dalam anggaran yang telah disetujui;

- Memberikan setiap jaminan atau penggantian kerugian, atau gadai, jaminan fidusia atau penunjukan, pembebanan atau hak jaminan lainnya atas harta kekayaan Perseroan;

- Mengikat Perseroan sebagai penjamin, untuk menjamin pembayaran atau pelaksanaan sehubungan dengan kewajiban setiap pihak ketiga;

- Setiap investasi (termasuk investasi/membeli atau dengan cara lain memperoleh hak atas tanah dan bangunan-bangunan; atau

- Memberikan pinjaman kepada nasabah (satu pihak peminjam) pembiayaan kendaraan bermotor roda empat dalam jumlah rupiah yang setara dengan US$100.000,- (Seratus Ribu Dollar Amerika Serikat) atau lebih, menggunakan nilai tukar mata uang asing yang dikeluarkan Bank Indonesia pada tanggal perjanjian pembiayaan.

Harus mendapat persetujuan terlebih dahulu dari keputusan rapat Dewan Komisaris.

- Direksi dilarang untuk melakukan tindakan-tindakan berikut di bawah ini tanpa mendapat persetujuan tertulis terlebih dahulu dari Dewan Komisaris, yaitu:

- Membuat kebijakan umum usaha; dan

- Membeli atau melepaskan aset tidak bergerak non-operasional yang mungkin menganggu operasional usaha Perseroan.

- Perbuatan hukum untuk mengalihkan, melepaskan hak atau mengikat Perseroan sebagai penjamin atau menjadikan jaminan utang harta kekayaan Perseroan yang merupakan sama dengan atau lebih dari 50% (lima puluh persen) jumlah kekayaan bersih Perseroan dalam 1 (satu) transaksi atau lebih, baik yang berdiri sendiri atau pun yang berkaitan satu sama lain dalam jangka waktu 1 (satu) tahun buku, wajib mendapat persetujuan RUPS yang dihadiri atau diwakili para pemegang saham yang memiliki paling sedikit ¾ (tiga per empat) bagian dari jumlah seluruh saham yang telah dikeluarkan dengan hak suara yang sah dan disetujui oleh paling sedikit ¾ (tiga per empat) bagian dari jumlah seluruh suara yang dikeluarkan secara sah dalam RUPS.

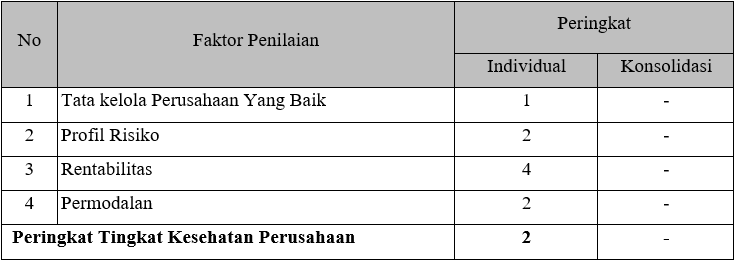

Penilian Tingkat Kesehatan Perusahaan

PENILAIAN RISIKO ATAS PENERAPAN KEUANGAN BERKELANJUTAN

- Tata Kelola Perusahaan yang Baik

Secara keseluruhan, Tata Kelola di Perusahaan berada pada Peringkat 1, adapun selama proses pemantauan tata kelola Perusahaan pada tahun 2024, terdapat beberapa kendala yang muncul dalam Struktur, Proses dan Hasil Penerapan Tata Kelola yang dapat dijabarkan sebagai berikut:

- Proses Tata Kelola

- Dalam penerapan manajemen risiko, SOP Unit Koordinator Head Collection (KHC) dan Unit Credit Control belum tersedia, sehingga pedoman terkait wewenang dan tanggung jawab masing-masing fungsi kerja belum mencakup tugas pokok dan fungsi (tupoksi) dari unit kerja yang baru terbentuk. Dalam hal ini, SOP masih dalam tahap penyempurnaan oleh divisi-divisi terkait.

- Dalam penerapan manajemen risiko, terdapat pedoman tentang pengendalian piutang tak tertagih (writeoff). Sehingga diharapkan di tahun 2025 untuk penghapusan piutang akan berjalan lebih baik dari tahun-tahun sebelumnya.

- Hasil Penerapan Tata Kelola

Rencana strategis perusahaan telah disusun berdasarkan peluang rentabilitas dan pertumbuhan aset di masa depan. Saat ini, perusahaan telah menerapkan kajian komprehensif yang mencakup analisis kebutuhan pasar, persaingan usaha, proyeksi ekonomi, serta identifikasi potensi kelemahan, ancaman, dan hambatan. Langkah ini memastikan bahwa rencana tersebut dapat diwujudkan dengan lebih terarah dan optimal.

- Proses Tata Kelola

- Profil Risiko

Secara keseluruhan, Profil Risiko di Perusahaan berada pada Peringkat 2 dan dapat ditampilkan sebagai berikut:

Kendala-kendala yang muncul dalam Profil Risiko atas keseluruhan faktor yang di nilai adalah sebagai berikut:

- Risiko Kredit

- Sebagian besar produk pembiayaan adalah pembiayaan modal kerja (74.63% dari total pembiayaan).

- Konsentrasi 25 Debitur Prioritas dengan OS > IDR 5 Miliar adalah > 61.75% dari total asset pembiayaan. Hal ini memberikan dampak pada risiko kredit dan berpotensi meningkatkan NPF secara signifikan jika terjadi gagal bayar dari sisi Debitur.

- Pertumbuhan pembiayaan naik s.d. 4.96% dengan penurunan terbesar ada di produk pembiayaan multiguna.

- Per bulan Desember, tingkat Gross NPF (Non-Performing Financing) tercatat sebesar 4.12%, mengalami penurunan dibandingkan dengan bulan November yang berada di angka 4.35%.

- 25.04% portofolio pembiayaan berasal dari Industri Batubara, situasi industri batubara saat ini relative stabil setelah fluktuatif dalam beberapa tahun terakhir, yang sebagian besar disebabkan oleh krisis energi global, namun di bulan Desember mengalami penurunan dan dalam forecast beberapa website internet menunjukan kenaikan di bulan Januari namun tidak signfikan.

- Risiko Likuiditas

Tidak terdapat peristiwa risiko likuiditas yang berpotensi merugikan Perusahaan dalam tahun 2024.

- Risiko Operasional

- Pelaksanaan cuti blockleave masih belum efektif karena adanya perbedaan peraturan internal di SHF, salah satu peraturan menyatakan bahwa karyawan harus mengambil cuti minimal 5 hari tetapi di sisi lain SHF menerapkan cut-off cuti internal sama dengan cuti Pemerintah (selama tahun 2024, cuti Pemerintah adalah 10 hari sehingga cuti internal yang tersisa hanya 1 hari).

- Ada beberapa gangguan sistem IT dan server tetapi cukup kecil seperti yang paling sering terjadi adalah hosting mail server & security (exabytes & vimana), dimana email dari eksternal tidak selalu bisa diterima, kebanyakan harus dikirim ulang dan ini sudah berlangsung cukup lama. Untuk core system terdapat masalah 1 kali.

- Risiko Strategi

Realisasi pencapaian laba bersih dibandingkan dengan rencana bisnis adalah -525.59% karena meningkatnya cadangan kerugian untuk akun yang menunggak akibat dari meningkatnya kredit macet dan penurunan pendapatan bunga pada tahun 2024, hal ini signifikan mengalami lonjakan khususnya di bulan Desember 2024.

- Risiko Kepatuhan

Tidak terdapat peristiwa risiko kepatuhan yang berpotensi merugikan Perusahaan dalam tahun 2024.

- Risiko Hukum

Tidak terdapat peristiwa risiko hukum yang berpotensi merugikan Perusahaan dalam tahun 2024.

- Risiko Pasar

Tidak terdapat peristiwa risiko pasar yang berpotensi merugikan Perusahaan dalam tahun 2024.

- Risiko Reputasi

Tidak terdapat peristiwa risiko reputasi yang berpotensi merugikan Perusahaan dalam tahun 2024.

- Risiko Kredit

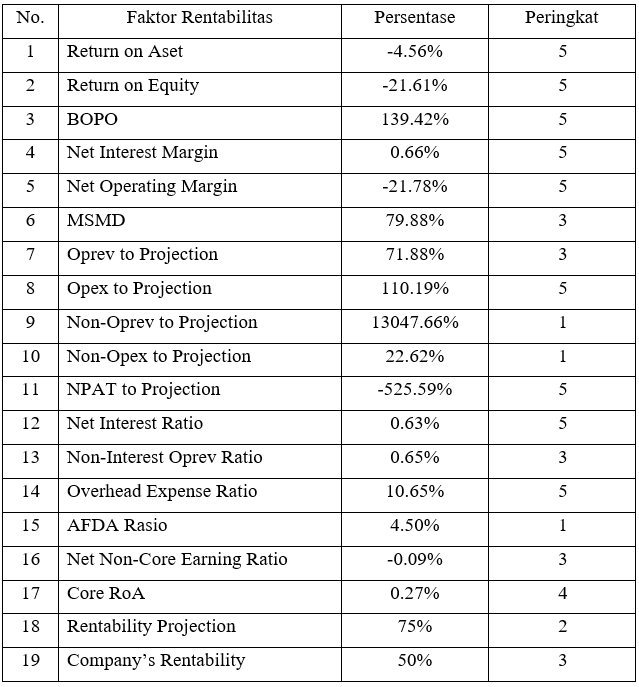

- Rentabilitas

Secara keseluruhan, kemampuan Perusahaan dalam menghasilkan keuntungan berada pada Peringkat 4 dari 19 faktor rentabilitas yang dapat ditampilkan sebagai berikut:

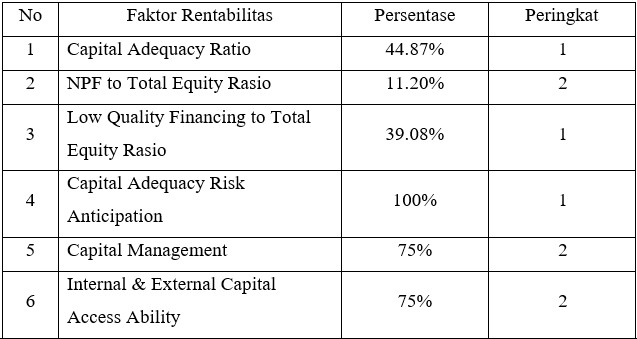

- Permodalan

Secara keseluruhan, kemampuan Perusahaan dalam memperoleh permodalan atau dukungan dana berapa pada Peringkat 2 dari 6 faktor permodalan yang dapat ditampilkan sebagai berikut:

PENGEMBANGAN KOMPETENSI MANAJEMEN

| Materi | Narasumber | Peserta |

|---|---|---|

| Profesi Penagihan | SPPI | 24 Karyawan Collection PT Sinarmas Hana Finance di tahun 2024. |

| Dasar Managerial Pembiayaan | SPPI | 11 Karyawan minimal setingkat Supervisor PT Sinarmas Hana Finance di tahun 2024. |

| Ahli Pembiayaan | SPPI | dihadiri oleh Mr. Jung Joon (Advisor) |

| Training General Affair “General Affairs Management Development Program” tanggal 25-26 Januari 2024 | Value Consult | dihadiri oleh Bapak Tri Gunardi (Staff General Affair) dan Bapak Muhammad Andrean Syah (Staff General Affair). |

| Global Culture Workshop “New Hana Kick Off 2024” tanggal 23-29 Januari 2024 | Hana Capital Korea | dihadiri oleh Bapak Agustinus Budi Antoro (Direktur Kepatuhan), Bapak Harist Siddiq (Kepala Unit Manajemen Risiko) dan Bapak Bonardo Situmorang (Kepala Cabang). |

| Kursus Brevet A dan B tanggal 03 Februari 2024 sampai 11 Mei 2024 | Universitas Podomoro | dihadiri oleh Ibu Silvia Usman (Kepala Unit Finance dan Accounting), Bapak Bong Rendy Wijaya (Sttaf Senior Accounting), Bapak Michael Aditya Sidartha (Staff Accounting) dan Ibu Jessica Siagian (Staff Accounting). |

| Training Tax “Taxation Update 2024” tanggal 24 Januari 2024 | MUC Consulting | dihadiri oleh Ibu Silvia Usman (Kepala Unit Finance dan Accounting) dan Ibu Meily (Kepala Unit Pajak). |

| Training Credit Analyst “Credit Analyst for Bank and Non Bank” tanggal 28-29 Februari 2024 | Value Consult | dihadiri oleh Bapak Arie Wihartono (Kepala Unit Kredit Analis), Bapak Jamali (Staff Kredit Analis) dan Bapak Made Lanang (Staff Kredit Analis). |

| Training Legal and Litigation “Business Contract: Drafting and Reviewing” tanggal 05-06 Maret 2024 | Value Consult | dihadiri oleh Ibu Clara Claudya (Staff Legal) dan Ibu Stellavia Paskah Helena (Staff Litigasi). |

| Seminar POJK Nomor 8 Tahun 2023 tanggal 27-28 Maret 2024 | Risiko Manajemen Gagasan | dihadiri oleh Bapak Indra Kusala (Kepala Unit Legal). |

| Training SLIK “Panduan Pengisian Laporan yang Benar Termasuk Cegah Denda Regulator pada Lembaga Keuangan Berdasarkan SEOJK Nomor 3 Tahun 2021" tanggal 19-20 Maret 2024 | Learning Media Indonesia | dihadiri oleh Ibu Ary Lestari (Staff Managemen Resiko). |

| Training Legal “Drafting and Reviewing MoU” tanggal 10-11 Juli 2024 | Value Consult | dihadiri oleh Bapak Andreas (Staff Legal). |

| Workshop Bussiness Area 1 PT Sinarmas Hana Finance tanggal 11-12 Juli 2024 | Direksi PT Sinarmas Hana Finance | dihadiri oleh Seluruh Pejabat Cabang Area Jabodetabek dan Bandung |

| Workshop Bussiness Area 2 PT Sinarmas Hana Finance tanggal 18-20 Juli 2024 | Direksi PT Sinarmas Hana Finance | dihadiri oleh Seluruh Pejabat Cabang Area Jawa Tengah, Yogyakarta dan Jawa Timur |

| Training Litigasi “Teknik Penagihan Tepat Guna untuk Bagian Penagihan” tanggal 05-06 Agustus 2024 | Mahaka Institute | dihadiri oleh Bapak Yusuf Ali (Staff Litigasi). |

| Training Risk Management Area 1 PT Sinarmas Hana Finance tanggal 06-07 Agustus 2024 | Risiko Manajemen Gagasan | dihadiri oleh Seluruh Pejabat Cabang Area Jabodetabek dan Bandung. |

| Training NPL Management Cabang Surakarta dan Yogyakarta PT Sinarmas Hana Finance tanggal 08-10 Agustus 2024 | Area Manager | dihadiri oleh Mr. Seo Jisu (Direktur Utama) dan Seluruh Pejabat Cabang Area Surakarta dan Yogyakarta. |

| Training Credit Analyst “Business Analyst” tanggal 10 Agustus 2024 | Blackbox Indonesia | dihadiri oleh Bapak Arie Wihartono (Kepala Unit Kredit Analis), Bapak Lingga Ary Chafifi (Staff Kredit Analis) dan Bapak Sofian Adi Gunawan (Staff Kredit Analis). |

| Training Risk Management Area 2 PT Sinarmas Hana Finance tanggal 13-14 Agustus 2024 | Risiko Manajemen Gagasan | dihadiri oleh Bapak Agustinus Budi Antoro (Direktur Kepatuhan), Bapak Yudha Himawan (Kepala Unit Managemen Resiko), Bapak Indra Setia Darma (Staff HR) dan Seluruh Pejabat Cabang Area Jawa Tengah, Yogykarta dan Jawa Timur. |

| Training Customer Service Center “Handling Difficult People and Complaints” tanggal 13-14 Agustus 2024 | Value Consult | dihadiri oleh Ibu Utaminingsih (Kepala Unit Customer Service Center) dan Ibu Resty Jayatiningsih (Staff Customer Service Center). |

| Global Culture Workshop Korea “One Spirit One Team” 22-28 Agustus 2024 | Hana Capital Korea | dihadiri oleh Ibu Agustina Dwi Mrabawani (Kepala Unit Operasional Support) dan Ibu Utaminingsih (Kepala Unit Customer Service Center). |

| Webinar “Return on Investmenr of Training (ROI of Training)” tanggal 24 Agustus 2024 | Online | dihadiri oleh Bapak Cornelius Yulianto (Kepala Unit HRGA) dan Bapak Indra Setia Darma (Staff HR). |

| Training Product Management Area 2 PT Sinarmas Hana Finance tanggal 09-13 Oktober 2024 | Internal PT Sinarmas Hana Finance | dihadiri oleh Seluruh Pejabat Cabang Area Jawa Tengah, Yogyakarta dan Jawa Timur |

| Training Product Management Area 1 PT Sinarmas Hana Finance tanggal 24-25 Oktober 2024 | Internal PT Sinarmas Hana Finance | dihadiri oleh Seluruh Pejabat Cabang Area Jabodetabek dan Bandung. |

| Training Excel pada 01 November 2024 | My Skill | dihadiri oleh Seluruh Karyawan PT Sinarmas Hana Finance |

| Training Internal Audit “GAP Communication for Internal Audit” tanggal 07 Desember 2024 | Blackbox Indonesia | dihadiri oleh Ibu Yulia Fitriyanti (Kepala Unit Internal Audit), Bapak Abdul Rozani (Staff Internal Audit), Bapak Febrian Wahyu Pangestu (Staff Internal Audit) dan Bapak Dedy Febriawan (Staff Internal Audit). |

| Training Consumer Protection in Financial Service Sector based on POJK Number 22 tanggal 05 Desember 2024 | Risiko Manajemen Gagasan | Dihadiri oleh Ibu Utaminingsih (Kepala Unit Customer Service Center), Ibu Indah Putri (Staff Customer Service Center), Bapak Indra Kusala (Kepala Unit Legal) dan Bapak Yudha Himawan (Kepala Unit Manajemen Resiko). |

KINERJA LINGKUNGAN HIDUP

Dalam rangka mendukung pelestarian lingkungan, Perusahaan melaksanakan kegiatan operasional yang ramah lingkungan sesuai komitmen dan rencana yang di buat dari tahun ke tahun. Perusahaan turut serta dalam upaya pelestarian lingkungan hidup dengan tujuan menciptakan kehidupan yang lebih baik. Partisipasi Perusahaan diwujudkan melalui upaya kebijakan, startegi dan tindakan yang telah di jabarkan di atas seperti pengurangan konsumsi kertas, penggantian mesin pendingin ruangan yang lebih hemat energi, penggunaan tumbler yang otomatis mengurangi sabun cuci piring dll.

Komitmen Perusahaan dibidang lingkungan hidup diwujudkan melalui penggunaan energi dan material dalam kegiatan operasional sehari-hari. Perusahaan memiliki kebijakan penggunaan energi dan material yang efektif dan efisien.

PENGGUNAAN KERTAS

Kebijakan penggunaan kertas sebagai salah satu material penting dalam kegiatan operasional terus dilanjutkan pada tahun 2024. Perusahaan diterapkan dengan penggunaan kertas secara efisien. Perusahaan senantiasa menghimbau kepada karyawan untuk meminimalisir penggunaan kertas baru dan lebih mendorong penggunaan atau pemanfaatan kertas bekas yang masih bisa terpakai di lingkungan kerja.

Perusahaan juga telah menggunakan mesin photocopy dan printer yang telah dilengkapi dengan PIN & Job Storage, sehingga atas setiap penggunaan dan pencetakan dapat dilakukan kontrol dan monitoring sesuai dengan kebutuhan yang benar-benar diperlukan.

Selain itu, mesin photocopy dan printer yang digunakan bisa untuk mencetak dokumen dua sisi (bolak-balik), sehingga bisa meminimalisir penggunaan kertas dalam jumlah banyak.

PENGGUNAAN LISTRIK

Dalam penggunaan listrik yang hemat dan bijaksana terus dilanjutkan pada tahun 2024, Perusahaan mengikuti kebijakan pengelola gedung tempat dimana Perusahaan menyewa ruangan kantor yang memanfaatkan listrik yang disalurkan dari Perusahaan Listrik Negara (PLN).

Adapun kebijakan penggunaan listrik yang diterapkan yaitu pembatasan waktu penggunaan AC dari jam 08.00 sampai tidak lebih dari pukul 17.00 WIB, selain itu penerangan lampu dibatasi pula hanya untuk yang benar-benar masih digunakan.

Perusahaan tidak mencatatkan penggunaan baik kertas, air dan listrik dalam volume. Pencatatan penggunaan energi dan material dilakukan dalam bentuk biaya yang dikeluarkan per bulan oleh Perusahaan secara keseluruhan.

E – MEMO

E – Memo adalah sebuah perangkat lunak yang dikembangkan oleh internal Perusahaan bertujuan untuk mempermudah dan mempersingkat setiap persetujuan-persetujuan yang sifatnya keseharian. Yang sebelumnya selalu menggunakan kertas dan banyak makan tinta print dan meminta ttd basah kepada pihak terkait hingga manajemen, namun sekarang cukup dengan menggunakan sistem E – Memo semua mudah dan berjalan lancar.

Penggunaan kertas pun berkurang hingga 65% dan printer pun sudah jarang digunakan. Walaupun masih ada beberapa hal yang diperlukan menggunakan kertas dan tinta serta tanda tangan basah, seperti halnya surat surat penting dan berharga.

TANGGUNG JAWAB PENGEMBANGAN PRODUK DAN/ATAU JASA KEUANGAN BERKELANJUTAN

Perusahaan dalam menyalurkan pembiayaan kepada debitur senantiasa memberikan layanan yang setara (adil), informasi yang transparan, serta memberikan perlindungan konsumen secara maksimal. Perusahaan memperhatikan batasan penyaluran pembiayaan seperti tersebut dibawah ini:

- Pembayaran uang muka sejumlah persentase tertentu dari harga mobil;

- Jangka waktu kredit adalah minimum 12 bulan maksimal 4 tahun;

- Mobil bekas yang kita biayai dibawah 10 tahun;

- Jenis mobil bekas yang tidak kita biayai adalah Ford, Datsun, Nissan, mobil produk Cina, tipe paling rendah/standar di setiap merk (kecuali Toyota Avanza type E);

- Selama masa pembiayaan mobil tersebut dilindungi dengan mitigasi risiko berupa sertifikat fidusia dan asuransi kendaraan.

Biaya-biaya yang Dikenakan Perusahaan kepada Debitur adalah:

- Biaya survei;

- Biaya notaris;

- Biaya provisi;

- Biaya administrasi;

- Biaya asuransi;

- Biaya pelunasan dipercepat.

Kebijakan penyaluran pembiayaan diatas telah memberikan dampak positif, baik kepada Perusahaan maupun kepada debitur.

Perusahaan senantiasa memberikan informasi yang jelas kepada calon debitur sebelum akhirnya debitur memutuskan untuk menggunakan jasa pembiayaan dari Perusahaan. Pengisian Formulir Aplikasi Permohonan Pembiayaan dilakukan oleh calon debitur itu sendiri bersamaan dengan keterangan yang diberikan oleh staf Perusahaan dan akan digantikan dengan format online di masa depan untuk mengedepankan keamanan serta perlindungan Konsumen.

Perusahaan juga memberikan saluran untuk keluhan pelanggan dimana saluran ini dapat digunakan oleh debitur untuk mengajukan keluhan atas produk dan jasa yang diberikan Perusahaan. Termasuk pengaduan atas kemungkinan pelanggaran terhadap privasi debitur maupun hilangnya data debitur dalam database Perseroan.